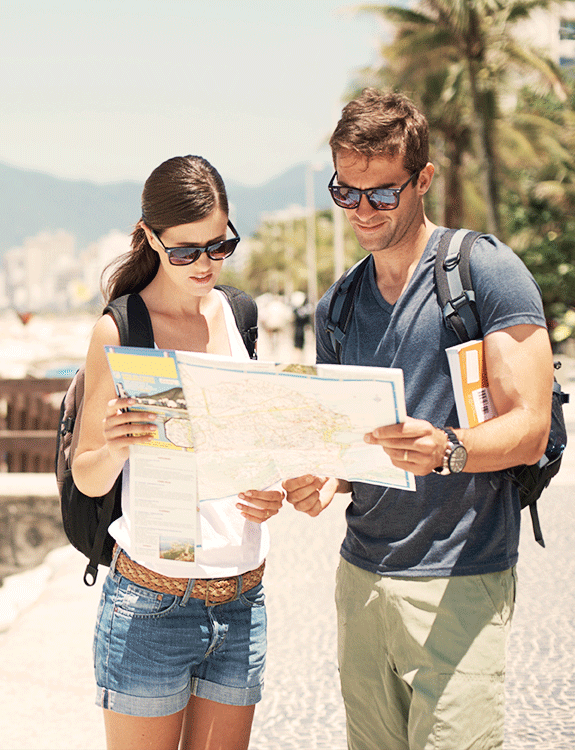

Travel Insurance

Need travel insurance for your next trip? Cover-More Travel Insurance offers a range of insurance options. In partnering with CGU Insurance, we can help you access Cover-More Travel Insurance.

Range of

options

24/7 worldwide

emergency hotline

Claim

online

Choose Your Cover

International Cover

Going overseas?

Travel more and worry less, knowing your travel insurance is sorted if things go wrong while you're away.

Cover-More’s International Travel Insurance plans give you a choice of cover options which can provide cover for overseas emergency medical expenses, personal liability, luggage and travel documents, cancellation costs and more.

Domestic Cover

Need a little extra protection for your Australian holiday?

Cover-More offer Domestic Comprehensive and Domestic Cancellation plans, if you’re an Australian resident travelling within Australia. Domestic travel insurance can help if something unexpected happens and you need to rearrange or cancel your trip (like if you get sick while you're away).

When you choose Domestic Comprehensive cover, your policy will include cover for:

- Luggage and travel documents

- Rental car insurance excess

- Travel delays

- Additional travel and accommodation expenses.

This cover has limits, sub-limits and exclusions, so read the Product Disclosure Statement (PDS) for full details of what’s covered.

Single or multi-trip options

Annual multi-trip

Annual multi-trip plans give you the flexibility to travel without the need to purchase a new policy for every trip.

- Gives you year round cover to destinations that are over 250 km from your home.

- Gives you year round cover to destinations that are less than 250km from home, if your trip includes at least one night of paid accommodation (like in a hotel or Airbnb).

- The option to select your preferred trip duration and the flexibility to take an unlimited number of trips within your annual policy period. You can choose 30, 45 or 60 days on the International Comprehensive Plan, or 15 or 30 days on the Domestic Comprehensive Plan.

Single trip

A Single Trip policy gives you insurance cover for one journey. If you don’t need cover for multiple trips in a year, consider if a Single Trip policy suits your travel needs.

COVID-19 Cover

If you are diagnosed with COVID-19 whilst travelling, we have benefits available on our domestic and international policies including cover for overseas medical costs.

Common scenarios for COVID-19 cover will be automatically included when taking out travel insurance with Cover-More. The level of benefits included will depend on the coverage and the type of policy you decide to purchase. COVID-19 benefits may include:

- COVID-19 cover for overseas medical costs1

- COVID-19 cover for cancellation and amendments2

- Cover for additional COVID-19 expenses3

To speak to us about an existing policy

Call 1300 889 137

Email CGU_travelinsurance@covermore.com

IMPORTANT DOCUMENTS

Product Disclosure Statement (PDS) and Financial Services Guide (FSG)

Australian Military Bank’s FSG

Limits, sub-limits, conditions and exclusions apply. Any advice provided is general only and does not consider your needs or financial situation. To see if the product is right for you, always consider the Product Disclosure Statement and Target Market Determination.

Need Help?

To speak to us about an existing policy

Call 1300 889 137

Email CGU_travelinsurance@covermore.com

Emergency assistance

If you need urgent help, you can call Cover-More 24/7

From Australia

1300 889 137

Depending on your needs, Cover-More can help if:

- You need to find a medical facility and/or a doctor who speaks English

- You need to pay medical bills (if your claim is approved)

- You’ve lost your passports, travel documents or credit cards

- You need legal help or help getting home

Calling from overseas

Cover-More also have numbers you can call from outside Australia. If you're in:

- New Zealand, call 0800 600 702

- The United Kingdom, call 0800 001 5068

- USA 833 462 8181

- Canada 1833 511 9289

- Any other country, call (02) 8907 5221

When you call, have your Cover-More Travel Insurance policy number handy and a phone number Cover-More can call you back on.

Claims

It's simple and easy to make a claim. Call Cover-More to get started.

From Australia: 1300 889 137

From overseas: (02) 8907 5221

Or lodge a claim online

Claim Online

Claim online now through Cover-More’s easy, 5-step process:

- Describe the incident

- Enter your expenses or losses

- Upload any supporting documents

- Provide your bank details

- Review and finalise your claim

You can save and return to an incomplete claim for up to 28 days.

Once you've lodged your claim, Cover-More will update you on how it's progressing within 10 working days.

Follow up an existing claim.

Cover-More understand that as a result of your incident, you might already be out of pocket. That's why Cover-More try to process claims as quickly as possible.

You'll hear from Cover-More within 10 working days from the time they receive your claim.

To check your claim's progress, log into Cover-More’s online claims centre or contact them for more details.